Much has changed - both in India and globally - since my last post. Markets around the globe seem to have caught a collective cold. I am probably feeling happy after quite a while in the markets, with so much pessimism going around. The markets have now tuned their radars to pick up the slightest of negative news flows to go on a free fall.

In this post, I take a look at some interesting developments in delinquency rates related to real estate and the response of the equity markets (S&P 500). Admittedly there are number of factors that have a bearing on the movement of the S&P 500 and one cannot see the causal effect of one on another in isolation. But as they say…sometimes the part is better than the whole…especially when trying to get a sense of how things fit together to form the larger picture!

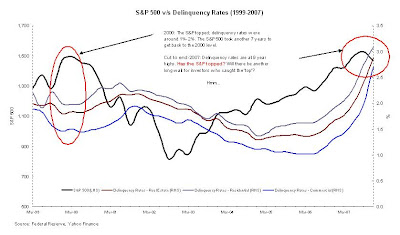

Again, what is the cause and what is the effect is a debatable issue here. Here is a chart depicting the movement of the S&P 500 and movement in delinquency rates for real estate, residential and commercial properties.

Again, what is the cause and what is the effect is a debatable issue here. Here is a chart depicting the movement of the S&P 500 and movement in delinquency rates for real estate, residential and commercial properties.

Looking at the low interest rates several players entered the real estate market with dollar signs in their eyes. They thought that the only way home prices could move was up and they leveraged themselves…well almost…to buy their dream home! But as they say all good things come to an end and this housing bubble too…

…The uptrend in the S&P which began in mid-2002 continued over the next five years. However interest rates were continuously rising during this time as the Fed worried about several things, not in the least among these being the build up of a possible housing bubble. Somebody had finally arrived to spoil the party. The continuously rising interest rates gradually led to a rise in defaults as people started feeling the pinch of costlier money. But somehow the equity markets were still oblivious to this development and continued rising…

Then suddenly – as always – the markets woke up and saw the above chart. Delinquency rates were at 8/9 year highs and everyone started wondering why on earth they were loading up on equities…

And the S&P started dropping...

2008 has been a forgettable year for most global markets. The fall in the S&P has triggered a fall in equity markets around the globe due to the coupling effect. What remains an unanswered question is whether the end 2007 peak will mark a repeat of the 2000 peak. Because if it does then those unfortunate people who correctly picked the top are in for a one way ride. Everyone says equities are one of the best asset classes in the long run. Ask a guy who picked the 2000 peak and see if you get the same answer. There is nothing that makes an asset class inherently good. Price paid is everything…

Delinquency rates have never been higher in the past 8/9 years but the S&P touched about the same level seen in 2000. The housing trouble seems far from over and a recession is almost the grim consensus currently. So till that time equity markets could be in for a choppy ride with an increased inclination to moving south rather than north. But there will be pockets of value waiting to be picked. One just needs to be patient and keep looking…

In the complex web of interconnected linkages, it is extremely tough to isolate one factor as the cause that leads to A, then B and then C. However, certain ‘indicators’ stick out like a sore thumb when overlapped with another. Delinquency rates and equities is one example. Credit spreads and equities are another. (For the curious: Check out this earlier post where I first played Dr. Doom. The S&P was at ~1520 then, its at 1380 now.)

I am fascinated and interested in unearthing these relationships. My other idol, the physicist Richard Feynman used to say this about physics – and something that is true in investing too –

I totally agree.

I will never claim to ‘predicting’ market levels. I cannot do that. I don’t know how to do that. But by continuously looking at things that might have a bearing on each other I maximize my chances of staying out of big trouble.

As my guru, Warren Buffett says,

“I have made money by staying out of trouble.”

Pearls of wisdom from God himself.

Comments

Relationship between delinquency rates and equity markets is very well explained...

also, i liked the last para of the article...

“I will never claim to ‘predicting’ market levels. I cannot do that. I don’t know how to do that. But by continuously looking at things that might have a bearing on each other I maximize my chances of staying out of big trouble.”

Anon...it would be nice if you could reveal your identity. Would love to stay in touch!

- HS